Track all markets on TradingView

BREAKING NEWS

- Stocks making the biggest moves after hours: eBay, Qualcomm, DoorDash, Carvana and more

- Fox News AI Newsletter: Jobs AI can’t take

- U.S. Imposes Sanctions on Chinese Companies for Aiding Russia’s War Effort

- Olga Fikotova Connolly, Olympian in a Cold War Romance, Dies at 91

- Ukraine war: US takes aim at Chinese firms in wave of sanctions targeting Russia

- UK begins detaining migrants set to be deported to Rwanda

- Marjorie Taylor Greene to force vote to oust US House Speaker Mike Johnson

- Viking shares rise 8% after cruise line operator’s market debut

- Pfizer beats earnings estimates, raises outlook on cost cuts and smaller-than-feared drop in Covid drug sales

- Bally Sports regional networks go dark for Comcast cable customers

Latest Stories

Tech & Gadgets

Fox News AI Newsletter: Jobs AI can’t take

Mehmet Aytekin, 28, left, checks his cell phone while waiting to board his United Airlines flight to Newark, N.J. at O'Hare International…

Read More...

Read More...

Repurposed Boeing 737 transforms into private jet villa soaring in luxury

Join Fox News for access to this content You have reached your maximum number of articles. Log in or create an account FREE of charge to…

Read More...

Read More...

Ask Kurt: How to avoid phishing scams, protect your iPhone

In the digital age, where our lives are intertwined with technology, scammers and hackers lurk in the shadows, always on the prowl for a…

Read More...

Read More...

The shape-shifting underwater robot pioneering the depths of the sea

Dive into the world of underwater exploration, and you’ll find a new player making waves: HERO-BLUE. This isn’t your average remotely…

Read More...

Read More...

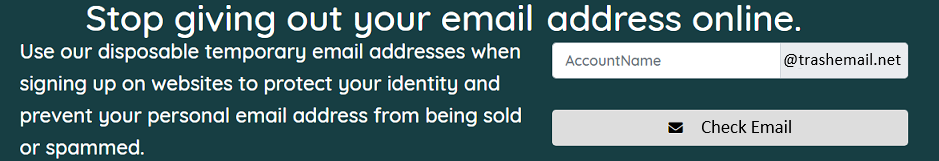

Never get locked out of your email again by doing this

Getting locked out of your email is no fun. To start, maybe you forgot your username or password, and now you have to go through all the…

Read More...

Read More...

How ‘Yahoo Boys’ use real-time face-swapping to carry out elaborate romance scams

We've all heard of catfish scams – when someone pretends to be a lover on the other side of the screen, but instead, they aren't who they…

Read More...

Read More...

Tesla Semi’s impressive performance on ice marks another major triumph

Join Fox News for access to this content You have reached your maximum number of articles. Log in or create an account FREE of charge to…

Read More...

Read More...

- Advertisement -