Track all markets on TradingView

BREAKING NEWS

- Ex-Boy Scout leader, teacher accused of sexually assaulting student for 2 years

- Deadly Florida carjacking victim’s father speaks out: ‘A big hit to our family’

- 3 Pennsylvania construction workers dead after being hit by truck on I-83

- Toddler dies after falling from third-story hotel window in South Dakota

- Child who survived 47-hour abduction from state park credited for airtight case against captor

- Woman, seeking loan, wheels corpse into Brazilian bank

- Palestinian Prisoners’ Day marked amid growing number of detentions

- Hezbollah launches missiles and drones at northern Israel

- Croatia ruling party heading for election win without majority: Exit poll

- Why is Pakistan expelling Afghan refugees?

Latest Stories

Tech & Gadgets

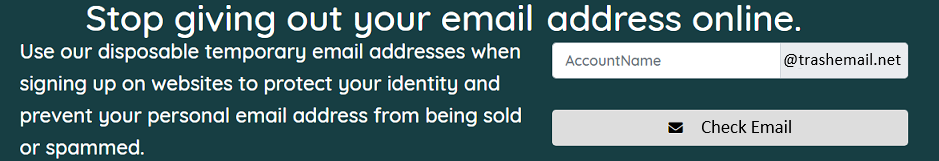

Nationwide alert: SMS phishing attacks target toll road customers

The FBI has issued a critical warning about a pervasive scam sweeping across the country.Americans are being targeted by a sophisticated…

Read More...

Read More...

Fox News AI Newsletter: Doctor’s groundbreaking surgery

Rodriguez detailed that the MARS system gives surgeons "two extra arms" for instrument control, as well as camera stability. (Levita…

Read More...

Read More...

European Union has requested details surrounding TikTok’s newest app that has quietly been…

European Union regulators said Wednesday they're seeking details from TikTok on a new app from the video sharing platform that pays users to…

Read More...

Read More...

Change this Apple Music setting ASAP to protect your privacy

In the age of oversharing, there’s something to be said for keeping a slice of your digital life to yourself, especially when it comes to…

Read More...

Read More...

Watch out for the new ‘ghost hackers’

Imagine if this happened to you. Your spouse passed away and a few weeks after the funeral, you get a message from them that says, "Hi, hope…

Read More...

Read More...

Is this technology the answer to cleaning up our ocean’s plastic problem?

In the vast, swirling expanse of the North Pacific Ocean lies a phenomenon as intriguing as it is troubling – the Great Pacific Garbage…

Read More...

Read More...

Cellphone nightmare leads to ported numbers, identity theft and fight for recovery

Imagine this scenario: You’re going about your day, and suddenly you can’t make calls or send texts. Little did you know, but you’ve become…

Read More...

Read More...

- Advertisement -